USA College Student Weekly Budget Breakdown By BlitzMoney

College life is a mix of fun, freedom, and figuring out how to stretch every dollar. But how much money does a college student need per week? Well, that depends on tuition, rent, food, and those must-have late-night snacks. Balancing expenses can feel overwhelming, but budgeting doesn’t mean cutting out all the fun—it’s about spending smart so you can cover essentials and still afford weekend plans.

With the right money strategy, you can handle bills, save for unexpected expenses, and still have enough left for that much-needed coffee (or pizza) break. Let’s break down the real costs of student life and how to manage them without going broke!

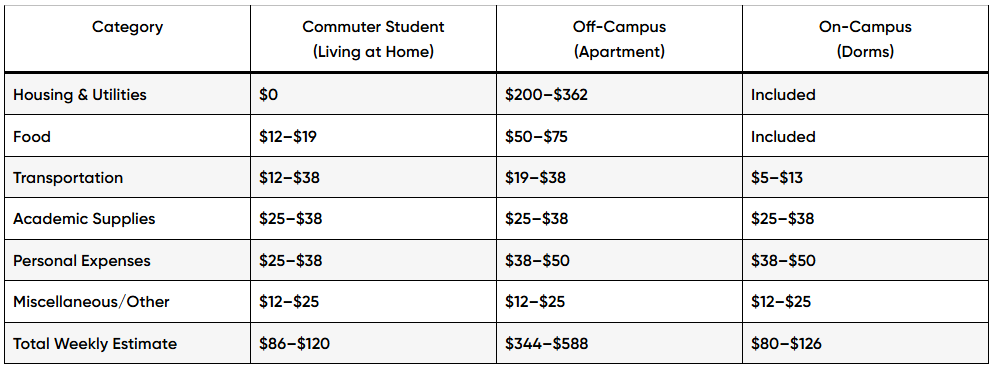

A Closer Look: Weekly Budgets by Student Lifestyle

Every college student weekly budget looks a little different—and a lot of that depends on where and how you live. Whether you’re commuting from home, sharing an apartment with roommates, or living in a campus dorm, your weekly costs can vary wildly.

To help you plan more accurately, we’ve broken down average weekly spending by student lifestyle. These estimates cover essentials like food, supplies, and personal expenses—giving you a realistic look at what you might need to budget each week.

These numbers are based on national averages and may vary by region and individual lifestyle. Still, they provide a helpful benchmark when planning a budget that fits your college experience.

College Student Weekly Budget Expense in 2025

Essential Expenses

Essential expenses are unavoidable costs that every college student must cover to maintain their daily life. These expenses include housing, food, textbooks, and transportation. Managing these costs is crucial, as they form the foundation of a student’s financial plan and are necessary for their overall well-being and academic success.

Housing Costs (On-campus vs. off-campus)

Housing costs vary significantly between on-campus and off-campus options. On-campus housing often includes utilities but can be more expensive, while off-campus rentals may offer lower costs but require budgeting for additional expenses like utilities and internet. Choosing the right option depends on personal finances and preferences.

According to national averages:

- On-campus housing (including meal plans) costs approximately $11,500–$12,500 per academic year, which breaks down to around $1,280–$1,390 per month.

- Off-campus housing (shared apartment): ~$650/month per student, plus ~$150 for utilities.

- Single occupancy apartment: ~$1,300/month.

Food Budget

A food budget covers the cost of groceries and dining out. Students should plan for both to ensure they have enough nutritious meals while avoiding overspending. College meal plans can help manage expenses but may require adjusting depending on individual eating habits.

- Average grocery + dining cost: ~$200–$300/month depending on location and eating habits.

- Meal plans (when included with on-campus housing) can simplify food budgeting.

Textbooks and Course Materials

Textbooks and course materials are necessary for academic success but can be costly. Students should budget for these expenses each semester and explore options like used books, digital versions, or library rentals to reduce costs. Proper planning ensures they have the resources needed for their studies without straining their budget.

- Average monthly cost: ~$100–$150

Transportation Costs

Transportation costs include expenses related to getting to and from campus, which may involve public transit, car maintenance, or gas. Students should account for these costs in their budget to ensure they can travel without financial stress. Using public transit or carpooling can help manage these expenses more efficiently.

- Public transit pass: ~$30–$75/month

- Personal vehicle: ~$100–$150/month including fuel, insurance, and maintenance

Unavoidable But Non-Essential College Expenses

Discretionary spending covers the extras that make college life more enjoyable—like movie nights, takeout, shopping, and fun with friends. These aren’t must-haves, but they matter for your well-being.

💡 Most students should keep this to 10–20% of their monthly budget. If you spend around $1,100/month (excluding rent), that’s about $27–$55 per week.

Here’s how it typically breaks down:

- Entertainment & Social Life: $30–$50/week — dining out, events, and outings.

- Personal Care & Clothing: $25–$40/week — grooming, toiletries, wardrobe basics.

- Tech & Electronics: $5–$7/week — saving for repairs or accessories.

- Emergency Buffer: $12–$25/week — for medical bills or unexpected costs.

🎯 Tip: Spend on what brings real value and set a cap on impulse buys. Smart spending lets you enjoy college without draining your wallet.

Are You Spending More Than This Weekly?

If your weekly expenses are creeping higher than the estimates above, it might be time to reassess your budget. Overspending—especially on non-essentials—can sneak up quickly in college. Whether it’s too many late-night food orders or unplanned shopping sprees, small costs add up fast.

Start by tracking your spending. Use budgeting apps like Blitz Money or a simple spreadsheet to see where your money goes. Set realistic spending limits for categories like entertainment, dining out, or clothes, and stick to them.

Even if you’re only overspending by $20 a week, that’s over $1,000 a year—money that could go toward savings, travel, or paying off loans. Blitz Money makes it easy to stay on track with features that help you manage your cash flow, set goals, and avoid unnecessary financial stress.

Creating a Realistic College Student Budget

When figuring out how much money does a college student need per week, having a solid budget is key. Start by tracking your income—whether it’s from a part-time job, financial aid, or side hustles—then break down your expenses into essentials (like rent and food) and discretionary spending (like streaming subscriptions and weekend outings).

💡 Want a head start? Check out this free College Student Budget Template to create your own budget quickly and easily. It’s designed specifically for student life and can help you track income, expenses, savings goals, and more—without the hassle of starting from scratch.

Conclusion

Managing your money in college isn’t just about covering bills—it’s about balancing spending, saving, and making smart financial choices. Knowing how much money does a college student need per week helps you plan better, avoid unnecessary debt, and stay in control of your finances. Tracking expenses, setting spending limits, and finding ways to earn extra cash can make a huge difference in your financial stability.

That’s where Blitz Money comes in! Get early access to your verified bank deposits between $9-$99 in 99 seconds for just 99¢/mo—and only pay when your deposits arrive. No interest. No credit checks. No due dates. No sneaky fees. Whether you need a little extra for groceries, rent, or weekend plans, Blitz Money keeps your cash flow smooth.